Tax Percentage On Bonus 2025 - Find out how much tax you will pay on your bonus with the bonus tax calculator. One of the most reliable and beneficial tax. The aggregate method involves combining the bonus.

Find out how much tax you will pay on your bonus with the bonus tax calculator.

Super Bawl 2025. Throughout super bowl week, enjoy events such as opening night. Super bowl […]

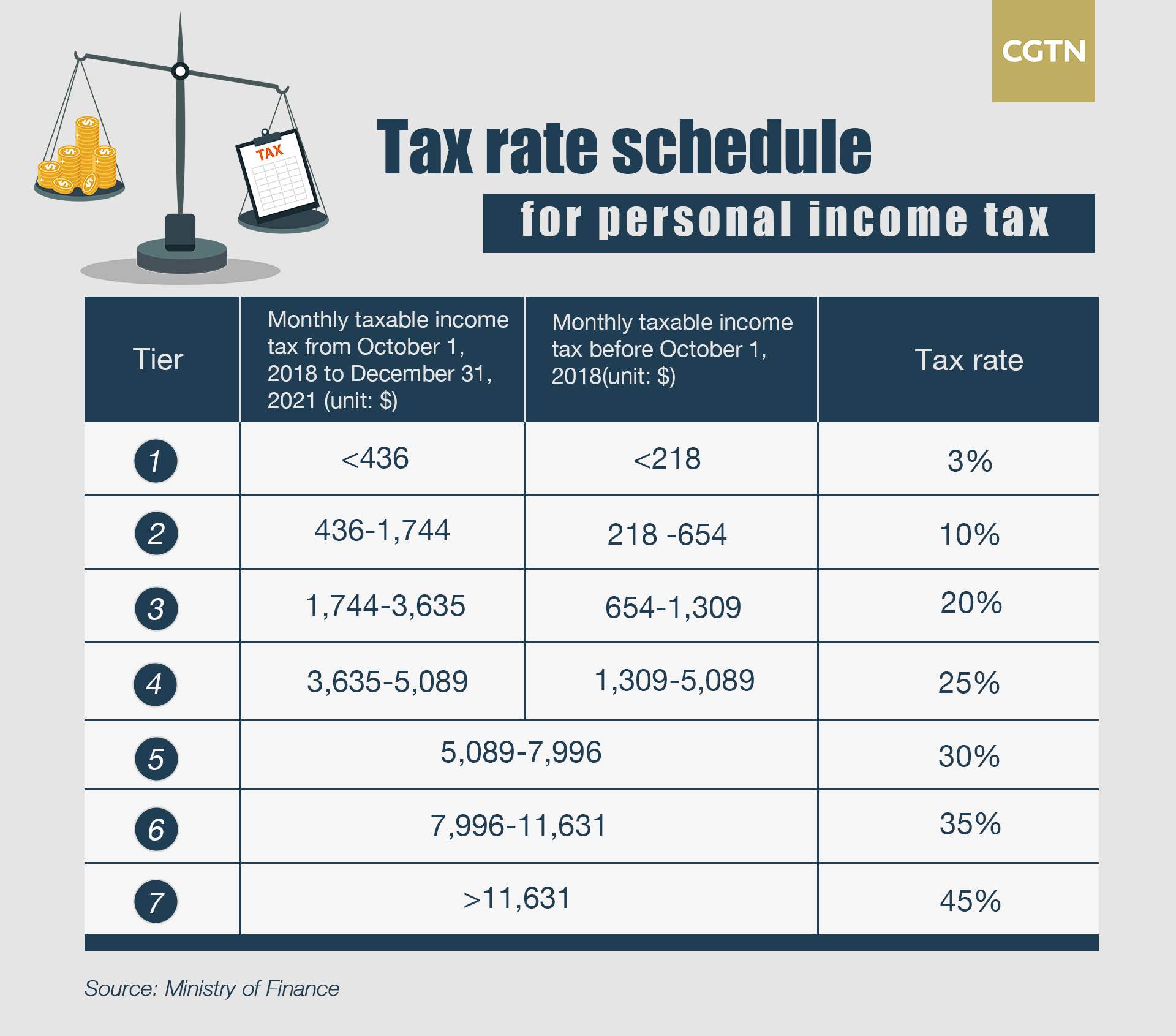

The amount of tax you pay depends on your income tax rate.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, What is the bonus tax rate? The amount of tax you pay depends on your income tax rate.

Tax Percentage On Bonus 2025. To effectively use the illinois annual bonus tax calculator for 2025, follow these simple steps: Bonuses are taxed at ordinary income rates but the government may initially withhold more money than usual.

Changes In New Tax Regime All You Need To Know, Kansas ranks third on our list of easiest states to save money, owing to its low cost of living, debt and housing prices. The flat rate is a straightforward method where a fixed percentage, often 22%, is withheld for federal taxes.

What Are The Different Tax Brackets 2025 Eddi Nellie, It uses the percentage method, which applies a flat percentage rate of 22% to bonuses under $1 million and a 37% rate to any portion exceeding $1 million. Input your current annual or monthly salary before the.

Tax rates for the 2025 year of assessment Just One Lap, Perentage bonus fixed amount bonus. If you receive a $3,000 bonus, with the aggregate method, you add that to your regular wage, $3,000 + $7,500 = $10,500, then multiply it by 12.

Listed here are the federal tax brackets for 2023 vs. 2025 FinaPress, Kansas ranks third on our list of easiest states to save money, owing to its low cost of living, debt and housing prices. His employer will withhold 22% of this bonus for.

How Are Bonuses Taxed? Ramsey, Click the 'calculate' button to process. The federal bonus tax rate is typically 22%.

Tax Return Extended Due Date 2025. Online tax returns and first payment on account due; […]